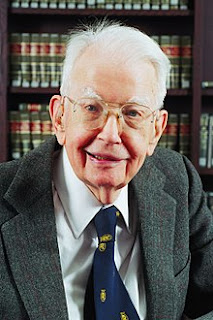

Ronald Coase

Ronald Harry Coase, born in 1910 and died in 2013, an English

economist well known for his contribution to Institutional Economics. In fact,

Coase wasn’t aiming to be an economist in the beginning of his academic life;

He got his bachelor commerce degree when he attended the London School of

Economics. In there, Coase was exposed to Economics for the very first time. His

professor, Arnold Plant introduced Adam Smith’s invisible hand to Coase in a

seminar. Professor Arnold showed Coase how a competitive economy uses pricing mechanism

to achieve equilibrium. And it was the time Coase started thinking, what if the

so-call invincible hand works so well, why there are abundant firms and organizations existing in markets? He wondered why don’t people just trade to

each other as an independent.

In 1931, Coase received Sir Ernest Cassel Travelling

Scholarship and visited University of Chicago. During his exchange in the United

States, he studied American industrial structures and tried to answer the

question: Why organizations exist? By observing famous companies at that time,

such as Ford Motor Company and General Motors Company, he realized the concept

of transaction costs, which are costs involve in buying or selling goods or

services. Coase concluded that it is too costly to an independent to stay in

market. An organization, instead, can hire independents or merge production

lines vertically in return of producing goods or services at a relatively lower

cost. In short, the existence of organizations is trying to avoid substantial

transaction costs in markets.

Coase ended his exchange and went back to UK in 1932. He

started teaching as an assistant lecturer at the Dundee School of Economics and

Commerce and organizing what he found in USA. In 1937, Coase published one of

his masterpieces “The Nature of the Firm”, which included topics related to

transaction costs, reasons why organizations exist and decision makings of organizations’

scale. He stated that organizations can decide whether to enter the market or

not based on transaction costs. For example, General Motors Company would not

enter tires producing market since the overall costs are too high, the company

rather buy tires from other companies. Subsequently, Coase published his second

masterpiece, “The Problem of Social Cost”. In this article, Coase brought

further discussion of transaction costs. He assumed that when transaction costs

are zero and property rights are well defined, there is no need for governments’

interventions to solve the problem of externalities. Considering Coase’s dedication

to the concept of transaction costs and the importance of defining property

rights, he received the Nobel Prize in Economics in 1991.

Few anecdotes showed that Coase was not good at mathematics,

which is quite different from my understanding of being an economist. He thought

that most economists focus too much on studying unrealistic math problems and

ignore the real problems in the market awaiting to be solved. He even used “blackboard

economics” to call economics which uses too much math. As a student who isn’t

good at math neither, I cannot agree with him more. In my opinion, a good

economist like Coase can show people why economic concepts are important without math; economics should be a knowledge which is understandable to everyone. Still,

I believe that math can be a strong langue to communicate or elaborate economic

scenarios more precisely.

References

https://en.wikipedia.org/wiki/Ronald_Coase

https://en.wikipedia.org/wiki/Coase_theorem

http://blog.udn.com/vchen123/2283342

https://buzzorange.com/techorange/2013/09/17/ronald-coase-ronald-h-coase-economist-who-won-a-nobel-prize-dies-at-102/

http://hk.apple.nextmedia.com/international/art/20130904/18407946

Next Tuesday, we will consider Coase's contribution and, in particular, his seminal paper The Nature of the Firm. It's what got this area of research started.

ReplyDeleteToo bad you don't like the math. You will be exposed to a fair amount of it in this course. In some cases I believe it is quite helpful in elucidating issues that otherwise would not be well understood.